Are CSGO trading bot more effective than human traders? In this article, we will explore the topic of “CS2 trading bot vs human trader: which is better?” by comparing their speed, decision-making, consistency, and adaptability. Discover which approach offers the best outcomes for your trading strategy.

Key Takeaways

- Automated trading bots provide instant execution and continuous operation, allowing for rapid responses to market opportunities that human traders may miss.

- Bots excel in analyzing multiple market conditions simultaneously, ensuring consistent performance without the emotional biases that can affect human decision-making.

- The future of trading will be driven by advancements in AI and machine learning, which are expected to improve the efficiency and effectiveness of automated trading strategies.

Instant Trade Execution

One of the most compelling advantages of automated trading bots is their ability to execute trades in milliseconds, significantly enhancing trading speed compared to manual execution.

This rapid execution means that bots can seize fleeting market opportunities that human traders might miss due to slower reaction times. Whether it’s a sudden price spike or a dip, the swift action of trading bots ensures they capitalize on these opportunities instantly.

Moreover, the continuous operation of trading bots contributes to their efficiency, especially during high-volatility situations. Continuous monitoring and rapid execution allow bots to outperform human traders in both speed and consistency.

This capability is particularly beneficial when trading across multiple exchanges, where timing can make all the difference.

Monitoring Multiple Market Conditions

Automated trading bots excel at:

- Processing vast amounts of live market data, allowing them to identify entry points amidst rapid price movements.

- Interpreting real-time data and recognizing momentum shifts.

- Executing trades at optimal moments.

This capability is crucial in the fast-paced trading environment, where missing a beat can result in lost opportunities that matter with precision in the game and new features. If you wait too long, you might be excited to miss out on valuable counter trades and success for customers.

This is a clear sign to note the importance of timely decisions in cs, especially with the latest item releases, the gap in money opportunities, and maps. Join the marketplace conversation to enhance your trading strategies and discover new ways to succeed in life.

Additionally, bots can handle multiple markets simultaneously, detecting trading opportunities across various asset classes more effectively than manual traders. Their ability to analyze multiple market conditions simultaneously ensures a level of consistency that human traders may struggle to maintain.

This adaptability ensures that trading strategies remain effective even as market conditions change rapidly.

Consistency vs. Intuition

Automated trading enables traders to maintain a disciplined approach by adhering to predefined strategies, eliminating emotional errors.

This consistency is particularly valuable in volatile markets, where sticking to a plan can make a significant difference. AI trading bots mitigate impulsive decisions by distinguishing genuine market movements from false signals.

In contrast, personal traders leverage intuition and past experiences to decide on their actions. While intuition can be beneficial, it also makes person traders susceptible to emotional biases.

However, person traders can adapt to sudden market changes through critical thinking, which is something bots might struggle with. This adaptability can be advantageous in unpredictable market scenarios.

24/7 Trading

A standout feature of trading bots is their non-stop operation, allowing them to seize market opportunities at any hour. Key advantages include:

- Bots do not require breaks, enabling continuous market analysis and execution.

- Their 24/7 availability allows traders to capture opportunities that may arise outside of regular trading hours.

- They operate regardless of geographical constraints, unlike human traders.

The use of trading bots, especially auto trading bots, reduces the need for traders to be constantly present, allowing them to focus on other tasks. Instant trade execution in fast-moving markets ensures bots do not miss any opportunities.

This continuous operation is a significant advantage in the global trading environment, where markets never truly sleep.

Emotional Influence in Trading

Emotions can significantly impact trading decisions, often leading to impulsive actions driven by fear, greed, or herd mentality. Human traders frequently experience the urge to overtrade near significant price levels due to emotional responses.

These emotional mistakes can result in substantial trading losses.

Automated trading bots operate without emotional biases, adhering strictly to programmed rules. This emotion-free operation offers several advantages:

- Avoiding common pitfalls like panic selling or impulsive buying

- Leading to more consistent performance

- Making decisions based solely on data and predefined strategies

- Maintaining a level of consistency often difficult for human traders to achieve.

Custom Trading Strategies

One of the significant advantages of automated trading is the ability to create custom strategies tailored to specific market conditions.

Platforms like Gunbot and TradersPost allow traders to develop strategies that automate their trading, integrating popular charting tools for enhanced market analysis.

This customization enables traders to optimize their performance based on specific market data.

Utilizing the right tools to create custom strategies can lead to more effective trading decisions and optimized outcomes.

TrendSpider, for example, provides a range of tools for strategy development across different asset classes, enhancing the flexibility and effectiveness of automated trading.

High-Volume Trading

AI trading bots are designed for high-volume trading, executing trades significantly faster than human traders. Key points include:

- Bots execute trades in around 0.01 seconds.

- Human traders execute trades in 0.1 to 0.3 seconds.

- Bots can handle high-frequency trading with ease.

- This rapid execution capability is expected to dominate future market strategies.

Additionally, AI systems can monitor and analyze thousands of market signals simultaneously, a feat that human traders cannot replicate.

This ability to process and act on vast amounts of data ensures that trading opportunities are not missed, making high-volume trading more efficient and profitable.

Backtesting Trading Strategies

Backtesting is a crucial step in validating custom trading strategies before deploying them in live trading. Analyzing historical data provides traders with insights into the effectiveness of their strategies, aiding in informed decision-making for future trades.

A well-conducted backtest reveals key performance metrics such as net profit, risk-adjusted returns, volatility levels, and a review of overall strategy performance.

Traders should consider the following when backtesting their strategies to execute strategies:

- Backtest over extended periods and various market conditions to ensure robustness.

- Customize backtesting parameters, including commissions and position sizing, for accurate results.

- Avoid over-optimization, as it can lead to misleading outcomes.

Resources for Automated Trading

A variety of resources are available for creating and customizing automated trading bots. The platform Gunbot supports a wide range of cryptocurrency exchanges, providing flexibility for traders. StockHero allows users to create and customize bots, connecting to various brokerage accounts for seamless trading.

Utilizing these resources can optimize the effectiveness and efficiency of automated trading strategies. Using the right tools and platforms enables traders to optimize their automated trading experience and achieve better outcomes.

Real-World Applications

AI-driven trading systems have proven to outperform human traders in real-world applications. Studies show that AI trading algorithms achieve win rates of around 60%-80%, compared to 40%-55% for human investors.

Hedge funds utilizing AI consistently generate annual returns that are 3% to 5% greater than those of traditional trading methods.

Automated trading strategies can yield 23% more profitability than traditional human trading methods.

In environments requiring quick decision-making, such as range trading and short-term scalping, AI systems excel, achieving higher returns with less volatility. This trading strategy demonstrates the advantages of automation in trading.

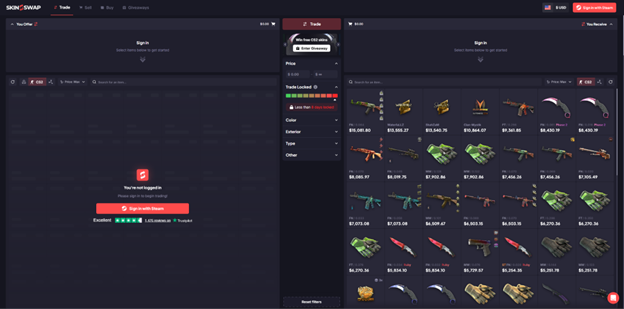

User Experience and Interface

Manual trading offers complete control and flexibility, allowing traders to adapt strategies instantly based on real-time market conditions.

This hands-on approach provides a sense of control that many traders value. However, the user experience of trading bots has significantly improved, providing intuitive interfaces and useful features.

Hybrid trading approaches combine human decision-making with automated execution, leveraging the strengths of both methods.

This combination allows traders to benefit from the speed and efficiency of bots while still making informed decisions based on their intuition and experience.

Cost Efficiency

Automated trading systems have demonstrated cost efficiency by achieving up to 23% higher profitability compared to traditional methods. Bots execute transactions in approximately 0.01 seconds, making them much faster than human traders, who generally take 0.1 to 0.3 seconds.

Additionally, AI systems can process over 1 million data points per second, far exceeding the data processing capabilities of human traders.

This efficiency in executing trades and processing data presents a compelling case for the cost-effectiveness of trading bots.

Security and Risk Management

Automated trading allows for precise risk management through:

- Setting stop-loss and take-profit orders to safeguard investments.

- Using real-time market data to dynamically adjust these levels, enhancing risk management capabilities.

- Quickly executing stop-loss orders to prevent excessive losses, a response that might take longer for human traders.

However, the complexity of trading algorithms in bots can sometimes lead to vulnerabilities, such as bugs or coding errors, increasing the risk of malfunction. Human oversight can provide a layer of security by enabling traders to monitor unusual activities that bots may not detect.

Future of Trading Bots

The ongoing evolution in automated trading technology is expected to significantly influence market dynamics and trading strategies. Emerging technologies like machine learning and artificial intelligence are projected to enhance the efficiency and effectiveness of trading bots.

These innovations will likely lead to more adaptive and responsive trading strategies, changing how traders approach the markets.

As trading bots become more advanced, their role in the trading ecosystem will grow, potentially leading to enhanced profitability and efficiency for traders. The future looks promising for automated trading, with continuous advancements shaping the landscape.

Summary

In summary, automated trading bots offer significant advantages in terms of speed, consistency, and 24/7 operation. They excel at processing vast amounts of data and executing trades rapidly, making them highly efficient in high-volume and volatile markets.

Human traders, while benefiting from intuition and experience, often struggle with emotional biases and inconsistent decision-making.

Ultimately, the choice between using a trading bot or relying on human intuition depends on individual preferences and trading goals.

As technology continues to evolve, the integration of AI and human decision-making may offer the best of both worlds, leading to more effective and profitable trading strategies.

Frequently Asked Questions

What are the main advantages of using a trading bot over a human trader?

Utilizing a trading bot ensures faster trade execution and consistent performance, while also eliminating emotional biases, allowing for continuous operation around the clock. This can significantly enhance trading efficiency and decision-making.

How do trading bots handle multiple market conditions?

Trading bots effectively adapt to multiple market conditions by analyzing real-time data and processing large volumes of information to identify trading opportunities. This capability enables them to swiftly respond to market fluctuations.

What is backtesting, and why is it important?

Backtesting is the process of evaluating trading strategies using historical data, which is crucial for assessing their effectiveness and predicting future performance before actual implementation. It helps traders make informed decisions and manage risk effectively.

Are there any risks associated with using trading bots?

Yes, trading bots can pose risks such as bugs and coding errors, making human oversight essential to monitor their activities and ensure correct functioning.

What is the future of trading bots?

The future of trading bots is promising, as advancements in machine learning and AI will significantly improve their efficiency and adaptability, resulting in more effective trading strategies.